CRM predictive modeling leverages data analysis to forecast customer behavior, enabling businesses to proactively personalize interactions and optimize sales strategies. This powerful technique moves beyond traditional CRM’s reactive approach, offering a proactive, data-driven methodology to understand and anticipate customer needs, ultimately driving revenue growth and improved customer relationships. By analyzing historical data and applying sophisticated algorithms, businesses gain invaluable insights into customer lifetime value, churn prediction, and optimal marketing campaigns.

This guide explores the core concepts, implementation steps, and ethical considerations of CRM predictive modeling. We will delve into the necessary data requirements, algorithm selection, model training and evaluation, and successful deployment strategies. Through real-world examples and case studies, we will illustrate the transformative power of predictive modeling in enhancing customer relationships and boosting business performance.

Introduction to CRM Predictive Modeling

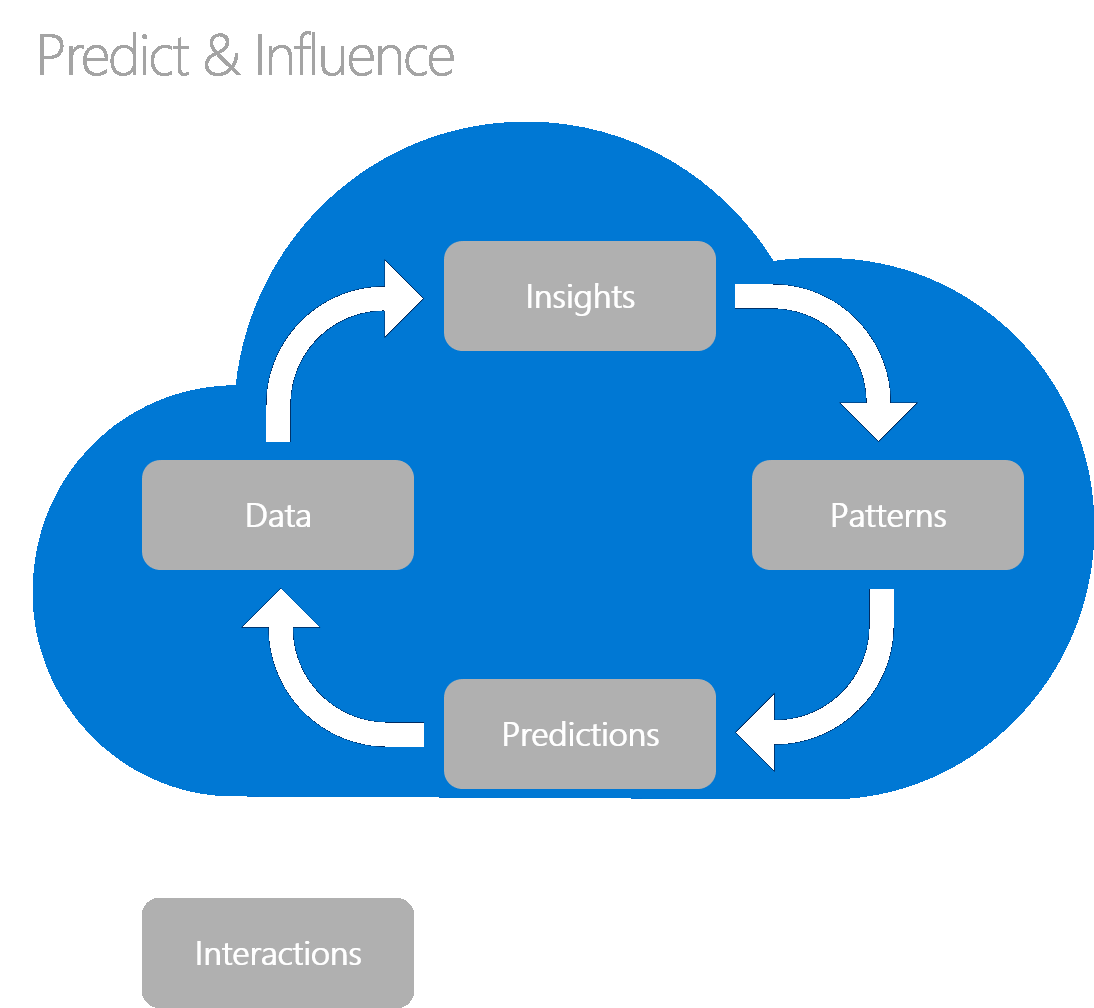

CRM predictive modeling leverages historical data and advanced analytical techniques to forecast future customer behavior and business outcomes. It goes beyond simply storing customer information; it actively uses that information to anticipate needs and personalize interactions, ultimately driving business growth. Core functionalities include identifying high-value customers, predicting churn, optimizing marketing campaigns, and personalizing customer experiences.Predictive modeling offers significant advantages over traditional CRM approaches.

Traditional CRM systems primarily focus on organizing and managing customer data, providing a historical view of interactions. In contrast, predictive modeling adds a proactive layer, enabling businesses to anticipate future trends and make data-driven decisions to optimize their strategies. This proactive approach leads to improved efficiency, increased profitability, and a stronger competitive edge.

Benefits of Implementing CRM Predictive Modeling

Implementing CRM predictive modeling provides several key benefits for businesses. By anticipating customer needs and behaviors, companies can personalize their marketing efforts, resulting in higher conversion rates and increased customer lifetime value. For example, a retail company might use predictive modeling to identify customers likely to purchase a specific product and target them with personalized email campaigns or discounts.

Furthermore, predictive modeling allows for the proactive identification of at-risk customers, enabling timely interventions to prevent churn and maintain customer loyalty. This proactive approach can significantly reduce customer acquisition costs and improve overall profitability. Finally, predictive modeling optimizes resource allocation by focusing efforts on the most promising leads and opportunities, maximizing return on investment (ROI).

Differences Between Predictive Modeling and Traditional CRM Approaches

Traditional CRM systems are primarily transactional, focusing on recording and managing customer interactions. They offer a reactive approach, responding to customer actions rather than anticipating them. Predictive modeling, on the other hand, uses advanced analytics to forecast future behavior and proactively guide business decisions. This difference is crucial: traditional CRM provides a historical perspective, while predictive modeling provides a forward-looking one.

A key distinction lies in their core functionality. Traditional CRM systems manage data; predictive modeling analyzes data to generate insights and predictions. This allows for a more strategic and efficient use of resources, ultimately leading to better business outcomes. For instance, a traditional CRM might track customer service interactions, while a predictive model might use that data to predict which customers are most likely to require additional support and proactively allocate resources accordingly.

Data Requirements for Effective Predictive Modeling

Accurate CRM predictive modeling hinges on the quality and completeness of the data used. The models are only as good as the information they are trained on; therefore, careful consideration of data requirements is crucial for building effective and reliable predictive models. Insufficient or poorly prepared data will lead to inaccurate predictions and ultimately, ineffective CRM strategies.

Essential Data Points for Accurate CRM Predictive Modeling

Several key data points are essential for building accurate predictive models within a CRM system. These data points, when combined effectively, allow for the creation of robust models capable of predicting customer behavior with reasonable accuracy. The specific data points will vary depending on the business objectives, but some common examples include customer demographics (age, location, gender), purchase history (frequency, recency, monetary value), website activity (pages visited, time spent on site), customer service interactions (number of calls, resolution time), marketing campaign responses, and social media engagement.

The more comprehensive and detailed the data, the better the predictive model will perform.

Data Preprocessing Techniques for Ensuring Data Quality and Reliability

Before using data for predictive modeling, it’s crucial to preprocess it to ensure quality and reliability. This involves several steps aimed at cleaning, transforming, and preparing the data for model training. These steps often include data cleaning (handling missing values, removing duplicates, correcting inconsistencies), data transformation (scaling numerical variables, encoding categorical variables), and feature engineering (creating new features from existing ones to improve model performance).

For instance, scaling numerical variables ensures that variables with larger values don’t disproportionately influence the model. Similarly, encoding categorical variables converts non-numerical data into a format suitable for model training. Feature engineering might involve creating a new variable representing customer lifetime value based on existing purchase history data.

Handling Missing Data and Outliers in CRM Datasets, CRM predictive modeling

Missing data and outliers are common challenges in CRM datasets. Several techniques can be used to address these issues. Missing data can be handled through imputation (replacing missing values with estimated values) using methods like mean/median imputation, k-nearest neighbors imputation, or more sophisticated techniques. Outliers, which are data points significantly different from the rest of the data, can be handled through various methods, including removal (if they represent errors), transformation (e.g., using logarithmic transformations), or using robust modeling techniques less sensitive to outliers.

For example, if a customer’s purchase history contains an unusually high value compared to their typical spending, this might be flagged as an outlier and require further investigation before being included in the model.

Data Types and Their Relevance in Predictive Modeling

The following table Artikels different data types and their relevance in predictive modeling:

| Data Type | Description | Example | Relevance in Predictive Modeling |

|---|---|---|---|

| Numerical | Quantitative data representing a measurable quantity. | Age, income, purchase amount | Used directly in many models; often requires scaling or transformation. |

| Categorical | Qualitative data representing categories or groups. | Gender, location, product category | Requires encoding (e.g., one-hot encoding) before use in most models. |

| Ordinal | Categorical data with inherent order. | Customer satisfaction rating (low, medium, high), education level | Can be treated as numerical or categorical, depending on the model. |

| Boolean | Binary data representing true/false values. | Subscribed to newsletter, made a purchase | Used directly in many models; often represents binary outcomes. |

Model Selection and Algorithm Choice

Selecting the right predictive modeling algorithm is crucial for the success of any CRM initiative. The choice depends heavily on the specific business objectives, the nature of the data available, and the desired outcome. A poorly chosen algorithm can lead to inaccurate predictions and ultimately ineffective CRM strategies. This section explores several common algorithms, comparing their strengths and weaknesses to guide the selection process.

Regression Algorithms for CRM

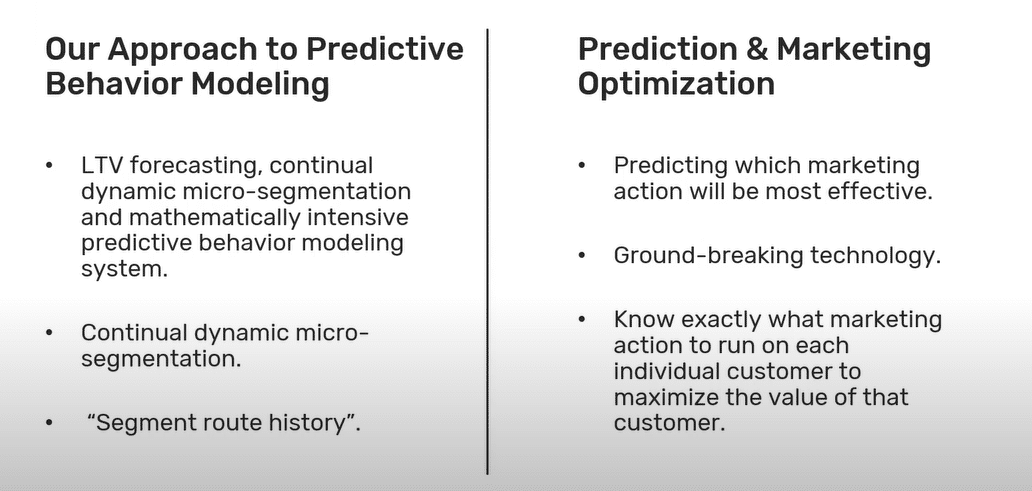

Regression algorithms are suitable when the target variable is continuous. For instance, predicting the lifetime value (LTV) of a customer is a regression problem. Several regression techniques exist, each with its own characteristics. Linear regression, for example, models the relationship between the dependent and independent variables as a linear equation. It’s simple to interpret but assumes a linear relationship, which might not always hold true in real-world scenarios.

Polynomial regression offers more flexibility by allowing for non-linear relationships, but can be prone to overfitting if not carefully managed. Support Vector Regression (SVR) uses support vectors to define a regression hyperplane, offering robustness to outliers. However, SVR can be computationally expensive for large datasets. Choosing between these depends on the complexity of the relationship between variables and the size of the dataset.

For example, if we are predicting customer spending based on demographics, a linear regression might suffice. However, if the relationship is more complex, involving interactions between variables, a polynomial regression or SVR might be more appropriate.

Classification Algorithms for CRM

Classification algorithms are used when the target variable is categorical. Predicting customer churn (will a customer leave?) or identifying high-potential leads are examples of classification problems. Logistic regression, a common choice, models the probability of a customer belonging to a particular category. It’s interpretable but assumes a linear relationship between the log-odds and the predictors. Decision trees offer a more intuitive and easily interpretable model that can handle non-linear relationships.

However, they can be prone to overfitting, especially with deep trees. Support Vector Machines (SVM) are effective in high-dimensional spaces and can handle non-linear relationships using kernel functions. However, SVMs can be computationally expensive and require careful parameter tuning. Random forests, an ensemble method, combine multiple decision trees to improve accuracy and reduce overfitting. Naive Bayes classifiers are simple and efficient, particularly useful for text classification tasks in CRM (e.g., sentiment analysis of customer reviews).

The choice depends on factors like interpretability needs, data dimensionality, and the presence of non-linear relationships. For example, predicting customer churn might benefit from a Random Forest model due to its ability to handle complex relationships and reduce overfitting, while a simpler Logistic Regression might be sufficient if interpretability is prioritized and the relationship between predictors and churn is relatively straightforward.

Clustering Algorithms for CRM

Clustering algorithms group similar customers together based on their characteristics. This can be valuable for targeted marketing campaigns or personalized customer service. K-means clustering is a popular choice due to its simplicity and efficiency. However, it requires specifying the number of clusters beforehand and can be sensitive to initial cluster centroids. Hierarchical clustering builds a hierarchy of clusters, allowing for a visual representation of customer segmentation.

However, it can be computationally expensive for large datasets. DBSCAN (Density-Based Spatial Clustering of Applications with Noise) identifies clusters based on data point density, making it robust to outliers and capable of identifying clusters of arbitrary shapes. However, it requires careful parameter tuning (epsilon and minimum points). The best choice depends on the desired level of granularity and the shape of the clusters in the data.

For example, segmenting customers based on purchasing behavior might be effectively achieved with K-means clustering, while identifying niche customer groups with complex characteristics might require DBSCAN.

Algorithm Selection Flowchart

A flowchart would visually represent the algorithm selection process. It would start with defining the business objective (e.g., churn prediction, LTV estimation, customer segmentation). The next step would involve assessing the data characteristics (e.g., type of target variable, number of features, data size, presence of outliers). Based on these characteristics, the flowchart would guide the selection to the most appropriate algorithm family (regression, classification, or clustering).

Finally, specific algorithms within the chosen family would be considered based on their strengths and weaknesses relative to the data and business objectives. For instance, if the objective is churn prediction (classification) and the data is high-dimensional with non-linear relationships, the flowchart would lead to algorithms like Random Forests or SVMs. If the objective is LTV prediction (regression) and the data shows a relatively linear relationship, the flowchart would suggest linear regression.

The flowchart would incorporate decision points based on data characteristics and business priorities to provide a systematic approach to algorithm selection.

Model Training and Evaluation

Training a predictive model using CRM data involves leveraging historical customer interactions and behaviors to build a model capable of forecasting future actions. This process is iterative, requiring careful consideration of data preparation, algorithm selection, and performance evaluation to ensure the model’s accuracy and reliability in predicting customer churn, sales opportunities, or other key metrics. The ultimate goal is to create a model that provides actionable insights for improving business strategies and optimizing resource allocation.The process of training a predictive model involves several key steps, from data preparation to model evaluation and refinement.

Successful model training relies heavily on the quality and representativeness of the training data, the choice of an appropriate algorithm, and a rigorous evaluation process to identify and address any shortcomings. Let’s explore these aspects in more detail.

Model Training Process

Model training begins with preparing the CRM data. This involves cleaning the data to handle missing values and outliers, transforming categorical variables into numerical representations (e.g., using one-hot encoding), and potentially feature engineering to create new variables that might improve model performance. Once the data is ready, it’s split into training and testing sets. The training set is used to teach the algorithm the patterns in the data, while the testing set is used to evaluate the model’s performance on unseen data.

The algorithm learns by identifying relationships between the input features (e.g., customer demographics, purchase history, website activity) and the target variable (e.g., churn probability, likelihood of purchase). The model’s parameters are adjusted during the training process to minimize the difference between its predictions and the actual values in the training data. For example, a model predicting customer churn might adjust its parameters to accurately classify customers who have churned in the past versus those who haven’t.

Model Evaluation Metrics

Several metrics are used to evaluate the performance of a predictive model. The choice of metric depends on the specific business problem and the relative importance of different types of errors. Common metrics include:

- Accuracy: The overall percentage of correctly classified instances. For example, an accuracy of 80% means the model correctly predicted the outcome in 80% of cases. However, accuracy can be misleading if the classes are imbalanced (e.g., far more non-churners than churners).

- Precision: The proportion of correctly predicted positive instances among all instances predicted as positive. For example, a precision of 90% for churn prediction means that out of all customers predicted to churn, 90% actually churned. This is crucial when the cost of false positives is high.

- Recall (Sensitivity): The proportion of correctly predicted positive instances among all actual positive instances. A recall of 70% for churn prediction means that the model identified 70% of the customers who actually churned. This is important when the cost of false negatives is high.

- F1-Score: The harmonic mean of precision and recall. It provides a balanced measure of both precision and recall, useful when both false positives and false negatives are important. The F1-score is calculated as:

2

– (Precision

– Recall) / (Precision + Recall)

Consider a scenario where a bank uses a predictive model to identify customers likely to default on loans. High precision is crucial to avoid lending to risky customers, while high recall is important to minimize the number of defaulters missed by the model. The F1-score would provide a balanced assessment of the model’s performance in this context.

Model Validation and Tuning

Validating and tuning a predictive model is crucial for ensuring its robustness and generalizability. This typically involves techniques like:

- Cross-validation: Dividing the training data into multiple folds and training the model on different combinations of folds to assess its performance across various subsets of the data.

- Hyperparameter tuning: Systematically adjusting the model’s parameters (e.g., learning rate, tree depth in decision trees) to optimize its performance on a validation set. Techniques like grid search or randomized search can be used for this purpose.

- Feature selection: Identifying and selecting the most relevant features to improve model accuracy and reduce overfitting. Methods such as recursive feature elimination can be used.

These techniques help to prevent overfitting (where the model performs well on the training data but poorly on unseen data) and ensure the model generalizes well to new, unseen customer data.

Steps for Model Training and Evaluation

The process of model training and evaluation can be summarized in these steps:

- Data Preparation: Clean, transform, and prepare the CRM data for modeling.

- Data Splitting: Divide the data into training, validation, and testing sets.

- Model Selection: Choose an appropriate predictive modeling algorithm based on the problem and data characteristics.

- Model Training: Train the chosen model using the training data.

- Hyperparameter Tuning: Optimize model parameters using the validation set.

- Model Evaluation: Evaluate the model’s performance on the testing set using relevant metrics (accuracy, precision, recall, F1-score).

- Model Deployment and Monitoring: Deploy the model and continuously monitor its performance to ensure ongoing accuracy and identify potential issues.

Model Deployment and Integration with CRM Systems

Deploying a trained predictive model into a live CRM environment requires careful planning and execution to ensure seamless integration and optimal performance. This involves not only the technical aspects of model integration but also the strategic alignment with existing CRM workflows and user expectations. Successful deployment hinges on a clear understanding of the model’s capabilities and limitations, as well as the ability to effectively communicate its insights to CRM users.The process of integrating a predictive model into a CRM system typically involves several key steps, from selecting the appropriate deployment method to establishing robust monitoring and maintenance procedures.

Different CRM systems offer varying levels of customization and integration capabilities, necessitating a tailored approach for each implementation. Furthermore, the chosen deployment strategy must consider factors such as scalability, maintainability, and the overall impact on system performance.

Deployment Strategies

Several strategies exist for deploying a predictive model into a CRM environment. These include real-time integration, batch processing, and hybrid approaches. Real-time integration involves deploying the model as a service that receives input data and generates predictions instantaneously. This is ideal for applications requiring immediate feedback, such as lead scoring or customer churn prediction. Batch processing, on the other hand, involves periodically running the model on accumulated data to generate predictions in bulk.

This is often more efficient for tasks that do not require immediate results, such as campaign optimization or customer segmentation. Hybrid approaches combine elements of both real-time and batch processing to leverage the strengths of each. The choice of deployment strategy depends heavily on the specific application, data volume, and performance requirements.

Integration with CRM Workflows

Integrating the predictive model with existing CRM workflows requires careful consideration of the model’s outputs and how they can be incorporated into existing processes. This may involve customizing CRM screens to display predictions, integrating the model with automation tools to trigger actions based on predictions, or modifying existing reporting and analytics dashboards. For example, a churn prediction model might be integrated with a CRM’s marketing automation system to automatically trigger retention campaigns for high-risk customers.

Similarly, a lead scoring model could be used to prioritize sales follow-up efforts by automatically assigning leads to sales representatives based on their predicted likelihood of conversion.

Model Performance Monitoring and Maintenance

Continuous monitoring of the deployed model’s performance is crucial to ensure its accuracy and effectiveness over time. This involves tracking key metrics such as accuracy, precision, recall, and F1-score. Regularly evaluating these metrics allows for early detection of performance degradation, which can be caused by changes in data patterns, model drift, or other factors. Model retraining and updates should be performed periodically to maintain accuracy.

This might involve retraining the model on new data or adjusting its parameters based on observed performance.

Presentation of Predictive Insights

Effective communication of predictive insights to CRM users is essential for successful adoption and utilization of the model. This can be achieved through various means, such as interactive dashboards, customized reports, or automated alerts.

Example: A dashboard could display the top 10 leads predicted to convert, along with their predicted conversion probability and relevant customer information.

Example: Automated alerts could notify sales representatives of high-priority leads or customers at risk of churning.

Example: Customized reports could provide a summary of predicted customer segmentation, enabling targeted marketing campaigns.

Case Studies and Real-World Applications

Predictive modeling in CRM systems has yielded significant returns for businesses across various sectors. The following case studies illustrate the diverse applications and impactful results achievable through strategic implementation. Each example highlights the business challenge, the chosen modeling approach, and the quantifiable improvements realized.

Case Study 1: Retail Customer Churn Prediction

| Industry | Business Problem | Model Used | Outcome |

|---|---|---|---|

| Retail (Apparel) | High customer churn rate leading to significant revenue loss. The company lacked a proactive strategy to identify at-risk customers. | Logistic Regression with features including purchase frequency, average order value, website engagement, and customer service interactions. | By identifying customers likely to churn, the company implemented targeted retention campaigns (personalized discounts, loyalty program enhancements). This resulted in a 15% reduction in churn rate within six months and a corresponding 10% increase in year-over-year revenue. |

Case Study 2: Financial Services Lead Scoring

| Industry | Business Problem | Model Used | Outcome |

|---|---|---|---|

| Financial Services (Banking) | Inefficient lead qualification process resulting in wasted sales resources on low-potential leads. Sales teams were spending excessive time on unqualified prospects. | Random Forest model incorporating lead demographics, online behavior (website visits, form submissions), and credit score data. | The lead scoring model prioritized high-potential leads, enabling sales representatives to focus their efforts effectively. This led to a 20% increase in conversion rates and a 12% improvement in sales efficiency (measured as leads converted per sales representative per month). |

Case Study 3: Telecommunications Customer Lifetime Value Prediction

| Industry | Business Problem | Model Used | Outcome |

|---|---|---|---|

| Telecommunications | Difficulty in identifying high-value customers and tailoring service offerings to maximize customer lifetime value (CLTV). The company lacked a clear understanding of which customers were most profitable. | Gradient Boosting Machines (GBM) utilizing data on service usage patterns, billing history, customer support interactions, and demographic information. | Predictive CLTV modeling allowed for the segmentation of customers based on their projected value. This enabled the implementation of customized retention strategies and targeted upselling/cross-selling campaigns, resulting in a 8% increase in average revenue per user (ARPU) and a 5% improvement in customer retention. |

Ethical Considerations and Challenges

Predictive modeling in CRM, while offering significant advantages, presents several ethical concerns that require careful consideration. The power to anticipate customer behavior raises questions about privacy, fairness, and transparency, demanding responsible implementation and mitigation strategies. Failure to address these ethical challenges can lead to reputational damage, legal repercussions, and a loss of customer trust.The use of CRM predictive modeling necessitates a thorough understanding of its ethical implications.

These models, while designed to enhance customer relationships, can inadvertently perpetuate existing biases, infringe on individual privacy, and lack transparency in their decision-making processes. Addressing these concerns is crucial for building responsible and ethical CRM systems.

Data Privacy Concerns

The effective use of predictive modeling relies heavily on vast amounts of customer data. This data, encompassing personal information, browsing history, purchase patterns, and more, is often sensitive and requires stringent protection. Failing to adequately secure this data exposes the organization to significant legal and reputational risks, particularly under regulations like GDPR and CCPA. Data breaches and misuse can lead to substantial fines and erosion of customer trust.

Robust data security measures, including encryption, access control, and anonymization techniques, are essential to mitigate these risks. Furthermore, organizations must obtain explicit consent from customers for the use of their data in predictive modeling, ensuring transparency and respect for individual rights.

Bias in Predictive Models

Predictive models are trained on historical data, which may reflect existing societal biases. If the training data contains biases related to gender, race, or other protected characteristics, the model will likely perpetuate and even amplify these biases in its predictions. For example, a model predicting loan eligibility trained on data reflecting historical lending discrimination might unfairly deny loans to individuals from certain demographic groups.

Addressing bias requires careful data curation, algorithm selection, and ongoing model monitoring. Techniques such as fairness-aware algorithms and bias detection tools can help identify and mitigate bias in the model’s outputs. Regular audits and independent evaluations are also necessary to ensure fairness and prevent discriminatory outcomes.

Transparency and Explainability

The complexity of many predictive models can make it difficult to understand how they arrive at their predictions. This lack of transparency can erode trust and make it challenging to identify and correct biases or errors. “Black box” models, where the decision-making process is opaque, raise significant ethical concerns. Strategies to enhance transparency include using more interpretable models, providing explanations for predictions, and allowing users to challenge or contest model outputs.

Employing techniques like LIME (Local Interpretable Model-agnostic Explanations) can help shed light on the factors influencing a model’s predictions, increasing user understanding and trust. This commitment to transparency is vital for responsible and ethical use of predictive modeling.

In conclusion, CRM predictive modeling offers a significant advantage for businesses seeking to optimize their customer relationship management strategies. By harnessing the power of data and predictive analytics, organizations can move beyond reactive approaches and engage in proactive, personalized interactions that drive revenue, improve customer satisfaction, and foster long-term loyalty. While ethical considerations and challenges exist, the potential benefits of effectively implementing CRM predictive modeling are undeniable, making it a crucial investment for modern businesses striving for competitive edge and sustainable growth.

FAQ Corner: CRM Predictive Modeling

What types of businesses benefit most from CRM predictive modeling?

Businesses with substantial customer data and a desire for personalized marketing and sales strategies, such as e-commerce, SaaS, and financial services, see the greatest benefits.

How much does CRM predictive modeling cost to implement?

Costs vary greatly depending on the complexity of the model, data volume, and the level of external expertise required. It ranges from relatively low-cost software solutions to substantial investments in custom development and data science expertise.

What are the common pitfalls to avoid when implementing CRM predictive modeling?

Common pitfalls include poor data quality, inadequate model validation, lack of integration with existing CRM systems, and neglecting ethical considerations.

How long does it take to see a return on investment (ROI) from CRM predictive modeling?

The ROI timeframe varies depending on factors like implementation speed, data quality, and the chosen model’s effectiveness. Some businesses see quick wins, while others require a longer-term perspective.